Here are a few of the things you’ll learn about this month:

- LISD rejects TEA rating system

- How you can help improve ratings

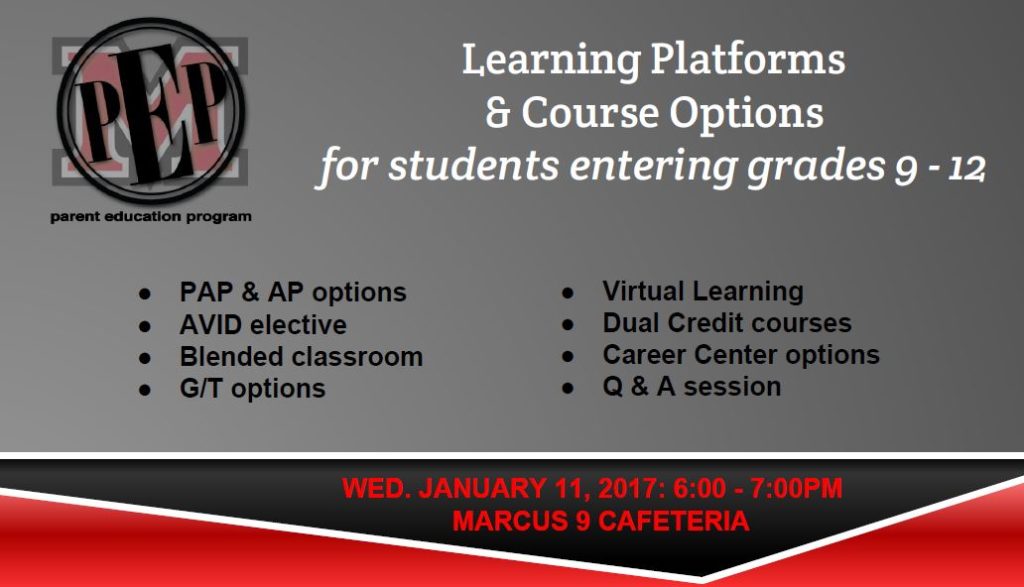

- New traffic guidelines

[wc_button type=”primary” url=”https://marcusptsa.org/wp-content/uploads/2012/08/Marcus-PTSA-Newsletter-2017-10-01.pdf” title=”Read It!” target=”self” position=”float”]Newsletter[/wc_button]

Reminder

PTSA Senior membership for MHS PTSA eligibility due by Tue, January 31, 2017.

PTSA Senior Scholarship Applications are due on Wed, April 20, 2016.

Welcoming in 2017 and looking forward to a great second half of the year.

Welcoming in 2017 and looking forward to a great second half of the year.

Seniors

You need to be a member of the Marcus HS PTSA by 31-JAN-2017 to be eligible to apply for the PTSA scholarships.

Join Now

LEF Scholarship applications are due by 27-JAN-2017 4:30p CT.

A representative from the Lewisville Education Foundation (LEF) will be on campus Friday 12/6, to assist students in completing their scholarship applications. This would be a great opportunity to make sure your application is ready to submit. She will be on campus all day tomorrow from 8:10 a.m. to 3:30 p.m. in B202. No appointment is necessary. Students are free to come-and-go or just drop in. However, students are not allowed to ask their teacher(s) to leave class to see the representative UNLESS they have a student assistant position and they are not needed for a specific project. Senior In or Senior Out would be a great time to drop in.

Learn MoreBeginning 04-JAN (Wednesday)

- Bussess enter from Waketon-stop at MHS9 and then MHS. Exit onto Dixon.

- All parent traffic is at the front of MHS9, MHS, and the north side band parking lot.

- No parent traffic in back parking lot. Students enter from Waketon or the top entrance of Dixon. Same for exiting in the afternoon.

MHS Parent Education Program

MHS Parent Education Program

When: Wednesday, 07-DEC-16 from 6:00p – 7:00p

Where: MHS Library

What: Student presentations on teens & social media

Free childcare is available.

State Assessment for Academic Readiness

State Assessment for Academic Readiness

Texas PTA will advocate for a reduced emphasis on state-mandated testing, focusing on grades 3-8, and monitor changes to STAAR for high school students, and limits on benchmark testing for all tested grades.

Background

Texas PTA has worked for several years to reduce the number of and the emphasis on state-mandated tests. We were part of a strong team that reduced high school end-of-course tests from 15 to 5 and have sought to reduce the number of tests that are required in the elementary and middle school grades. We will continue to look for opportunities to pursue these reductions during the next legislative session.

Texas PTA seeks to extend the graduation committee structure created last session through House Bill 149, one in which students who have passed all the courses required for graduation but have been unable to pass up to two of the end-of-course exams required to graduate, can participate in a rigorous process to demonstrate that they have learned the required curriculum. The committee that assigns extra activities, and reviews the student’s work must agree unanimously in order for the student to be allowed to graduate.

Read more about the history of efforts to reduce STAAR.

Oppose Vouchers

Texas PTA will oppose vouchers including Education Savings Account Programs (ESA Programs) and Tax Credit Scholarship Programs that allow state funds to be utilized in private schools not accountable to the taxpayer or the state.

ESAs are a form of voucher that allows eligible parents to use a portion of the funds the state expends for their student’s public school education to fund private school tuition, tuition at eligible institutions, distance education, home schooling materials and curriculum. The remainder of the funds, generally around 30%, are kept by the public school the student previously attended.

Corporations can earn tax credits by donating money to a scholarship program that uses the dollars to pay for private school tuition for students.

Vouchers:

- Do not ensure accountability – They send public dollars to private schools that are not accountable to the public for producing results.

- Provide choice for some, not all –

- Vouchers disproportionately benefit students living in urban areas due to limited access to private schools in rural Texas.

- Vouchers do not address many needs of low-income, at-risk students such as transportation, free and reduced lunches, textbooks, assessment of special needs, access to additional remediation programs, full cost of tuition.

- Violate separation of church and state

- The US Constitution prohibits any government “establishment of religion.” Tax dollars directed toward public schools of religious origin violate that principal.

- The US Constitution ensures “free exercise of religion”; no government has proper authority to dictate a religious community’s expression of faith. Regulation and oversight always accompany allocation of public tax dollars, thus violation religious freedom.

Did You Know?

Only a portion of your property taxes, which is marked for schools, actually goes to your local school district. There is a tax rate cap on those funds that go to your local school district. The remaining funds are sent to the state for legislators to spend at their discretion. Often these remaining funds are spent on other state expenses like transportation.

Wouldn’t it be great if the state reinvested those remaining funds back into our public school system, so that our students will have more access to resources and facilities that they need to be successful? While reinvesting these funds back into public school will not solve all of our public school challenges, it would be a great jump start in improving the education of our students.

To learn more about how school financing works, you can access many articles and presentations online, or invite the CFO of your school district to explain how school financing works and what it means for your school district. Then join us at Rally Day February 27, 2017 as PTA and community members from across the state come together to advocate for these funds to be reinvested back into public schools, as well as many other issues that affect the education, well-being and the safety of our students.